Life Insurance

We broker with several companies and offer competitive term or permanent life policies. Some of these can be an alternative combination of life and/or long term care, or for any critical care such as cancer. You can accelerate the death benefit to help mitigate the costs of life’s unexpected illnesses or events.

We offer plans which can pay out tax-free lifetime income benefits in retirement. Call for term and permanent Life insurance quotes today!

Below is additional information on Long term Care. By proper planning, a life insurance policy can include many additional risks besides life, including disability such as long term care, critical care, and terminal illness.

We want to share a portion of this great article from CBS News (www.cbsnews.com October 19, 2014)

Aging in America: Stuck in the middle

Senior citizens whose finances fall IN THE MIDDLE — not rich, not poor — can find themselves in a real bind if they need home care. And their loved ones can find themselves caught in the middle as well. Our Cover Story is reported now by Rita Braver:

“This is my calm before the storm,” said Kathy Warren, as she sat at her kitchen table doing a puzzle. “It kind of centers me.”

But Warren is still keeping watch out her window, on her 92-year-old stepfather next door.

“As long as I know he’s sitting there, doing something, I know he’s fine,” she said.

Most of the rest of her day, in a modest mobile home park in Hayward, Calif., will be spent on his care.

Every day.

She’s been looking after him full-time since her mother died four years ago. “I haven’t been able to visit my son,” Warren said. “I haven’t been able to see my granddaughter. My life is really on hold.”

Braver asked George, “Do you feel lucky that you have someone like Kathy in your life?”

“Oh, absolutely,” he replied. “Like I say, I wouldn’t know what to do without her.”

And Warren, 66, a breast cancer survivor who struggles herself to get by, has been unable to get any government help for her stepdad.

“Is it surprising to you that there’s just no place where people know that they can turn when they get into this situation?” asked Braver.

“It’s surprising to me now,” said Warren, “but back when I was working, this wasn’t even on my radar. And all of a sudden I found out that there really are no resources out there for somebody who is in the situation that my dad is. He’s kind of in the middle.”

“In the middle”: Not poor enough to quality for Medicaid (which, unlike Medicare, does cover many long-term care expenses), and not rich enough to pay for long-term care. So the burden falls on his stepdaughter.

“I don’t look at that as a sacrifice; I just look at it as, that’s just the way life is right now,” she said. “Like when I had cancer, it’s just one day at a time.”

And she is not alone. According to the Family Caregiver Alliance, some 45 million Americans are currently caring for an elderly family member.

Former Democratic Senate Majority Leader Tom Daschle says the problem of long-term care is becoming a national crisis, as more of us are living longer with limited resources. “I can’t tell you the number of people that have told me they’ve given up everything — they’ve sold cars, they’ve sold property, they’ve sold furniture, they’ve sold things that they otherwise would have kept, just to pay for their parents’ care,” he said.

Daschle and a bi-partisan group of former public officials have created a task force to try to draw attention to the issue. “Care is highly-fragmented, and as a result available services and support are not coordinated,” he said.

Braver asked, “Is there an estimate of how many people aged, say, 65 and older will at some point in their lives need long-term care?”

Daschle replied, “The amazing statistic — and it is still one that’s hard for me to get my arms around — is that 70 percent of people over the age of 65 will need care of some kind, whether in their home or in institutions before the end of their life.”

That’s tens of millions of people . . . and while there are insurance policies that cover long-term care expenses, they are out of financial reach for many.

“Unfortunately, only seven percent of people who are in need of long-term care are able to rely on private insurance options today,” Daschle said. “These are really big issues for most families. And you tend to put them off until you really have to address them.”

The title of cartoonist Roz Chast’s illustrated memoir, “Can’t We Talk About Something More Pleasant?” (a finalist for this year’s National Book Award), says it all. “No one wants to talk about it; it’s awful” she said.

It’s the story of the decline of her late parents: her dad, a Brooklyn public schoolteacher; her mom, a vice principal.

“You found yourself more and more playing the role of helper,” said Braver, “and you were very frank in saying you really didn’t want to.”

“Well, I didn’t want to, and they didn’t want me to,” replied Chast. “So it was kind of like nobody wanted any of this to be happening. But it does.”

Her parents, like many older Americans, resisted leaving home for assisted living — “The Place,” as they called it. When, in their nineties, they finally made the move, worrying about expenses took a huge toll on the whole family.

“Make sure to scrimp and save every penny of your precious earnings . . . and when your scrimpings run out,

1) Go into your children’s scrimpings, and/or

2) Play and win the lottery, and/or

3) Apply for a Guggenheim, and/or

4) Start smoking, and/or

5) Take hemlock.

*****************

We also want to share a portion of this great article too (www.prnewswire.com April 07, 2014).

America’s Long-Term Care Crisis: BPC Launches Initiative to Find a Politically and Fiscally Viable Path Forward to Improve the Financing and Delivery of Long-Term Care

Washington, D.C. – In the next two decades, an aging population, fewer family caregivers, increasingly limited personal financial resources, and growing strains on federal, state, and family budgets will create an unsustainable demand for long-term care. Over the past 20 years, policymakers have debated different solutions, but have failed to reach consensus on a sustainable means of financing and delivering long-term services and supports. Failure to find that consensus well before the baby boom generation begins to need long-term services and supports (LTSS) will strain our long-term care safety-net to the breaking point.

The Bipartisan Policy Center’s (BPC) Health Project announced today a new initiative to find a politically viable and fiscally sustainable path forward to improve the financing and delivery of LTSS for America’s aging population and working-age Americans with disabilities.

BPC’s new Long-Term Care Initiative (LTCI) is led by former Senate Majority Leaders Tom Daschle and Bill Frist, former White House and Congressional Budget Office Director Dr. Alice Rivlin and newly appointed BPC Senior Fellow and former Secretary of Health and Human Services Tommy Thompson.

“Nearly 70 percent of Americans who reach age 65 will, at some point, be unable to care for themselves without assistance,” said Senator Daschle. “Issues of long-term care also affect millions of younger people with significant cognitive or physical functional limitations. Yet long-term care gets neither the public attention nor the policy focus that it deserves.”

Today, the co-chairs of the new initiative released a white paper, America’s Long-Term Care Crisis: Challenges in Financing and Delivery. The paper identifies the major challenges to the financing and delivery of long-term services and supports for seniors and individuals with disabilities under 65 including:

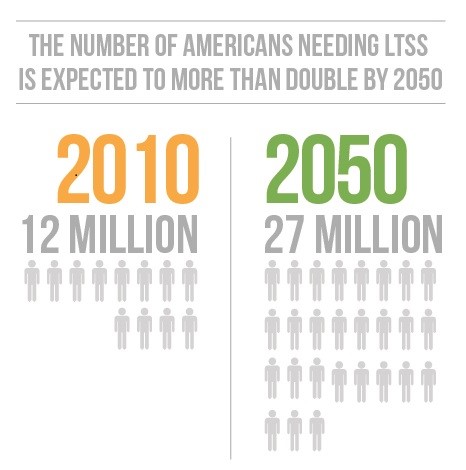

- The population needing long-term care is expected to double between now and 2050.

- Significant diversity in populations will need long-term care and will require a wide-range of assistance and types of services.

- Medicaid, a safety net program, covers the cost of the majority of paid LTSS, at well over $100 billion annually. As the baby boom generation ages, this amount is projected to grow rapidly at a time when federal and state budgets will be stretched.

- Limited options are available for individuals and families seeking to prepare for potential LTSS costs, and the private long-term care insurance market remains small relative to public programs as a source of LTSS financing.

The BPC initiative will work to find a policy pathway that addresses the nation’s current and projected need for long-term care. It will focus on integrating and emphasizing the role of long-term care within organized systems of care delivery and payment, and exploring sustainable approaches for financing at the individual, family, state, and national levels.

“Currently, the U.S. lacks a comprehensive strategy for the financing and delivery of long-term care,” said Secretary Thompson. “Individuals and family caregivers in need of long-term services and support often face limited coverage and ruinous out-of-pocket costs, and state and federal programs shoulder a growing and unsustainable financial burden of America’s aging population.”

The number of Americans estimated to need long-term care is expected to more than double from 12 million in 2010 to 27 million in 2050. As such, public and private spending on long-term care for the elderly is projected to grow from 1.3 percent of GDP in 2010 to 3 percent of GDP in 2050.

“We as a nation do not have, either in the private or public sector, satisfactory mechanisms for helping people anticipate and pay for long-term care,” said Dr. Alice Rivlin. “When individuals and their families seek help, they find, often to their surprise, that long-term care costs are not covered by Medicare or private health insurance, and learn that they will need to exhaust their resources to obtain coverage through the Medicaid program.”

“We as a nation do not have, either in the private or public sector, satisfactory mechanisms for helping people anticipate and pay for long-term care,” said Dr. Alice Rivlin. “When individuals and their families seek help, they find, often to their surprise, that long-term care costs are not covered by Medicare or private health insurance, and learn that they will need to exhaust their resources to obtain coverage through the Medicaid program.”

“Without innovative changes in policy, the nation faces challenging trade-offs between spending to meet our commitments to older and low-income Americans and investments in the nation’s future prosperity,” said Senator Frist. ”We must develop a realistic, yet politically viable set of policy options – including privately funded solutions – to take the burden off of government and instill greater efficiency in the way we deliver long-term care.”

The work of the initiative will build on BPC’s Health Project’s recent Health Care Cost Containment Initiative (HCCI), which released a broad set of recommendations for improving quality and containing cost growth across the entire health care system in its report…..

More great info: